how to file taxes if you're a nanny

If youre determined to file your taxes by yourself make sure youre using the best programs available. If you file Schedule H Form 1040 PDF you can avoid owing taxes with your return if you pay enough tax before you file your return to cover both the employment taxes for your household employee and your income tax.

How To Pay Nanny Taxes Yourself Care Com Homepay

If youre the employer of a household employee you have a responsibility to withhold and pay certain taxes on their behalf including the nanny tax If you work as a nanny self-employed babysitter or other household caregiver or you employ one youll want to know how to properly prepare your taxes.

. The Clark County Assessors office just finished mailing out Tax Cap Abatement notices. Depending on how you set up your LLC with the IRS you might file business taxes as a corporation a partnership or a single-member LLC. The maximum annual increase is 3.

What It Is Who. Youll also need to file a Form W-2 Wage and Tax Statement and furnish a copy of the form to your nanny and Social Security Administration. Fill out Form W-4 before your first day of work.

With Savvy Nannyyoure charged one flat rate for up to two employees with only an extra 6 per person charge after that. A nanny who has been in the US. If youre doing your 2020 taxes heres what you should know about the Child Tax Credit.

See Consequences of Unlawful Presence in the US. Unlike a deduction that reduces the amount of income the government gets to tax. If youre filing taxes there are a few key due dates to keep in mind.

The 8 Best Nanny Payroll Software - April. If you employ a nanny babysitter maid gardener or other household worker but you arent filing a federal income tax return Form 1040 you must file Schedule H and pay 2021 employment taxes. If your LLC has multiple owners its taxed just like a partnership.

All babysitters will pay federal income taxes based on their tax bracket. Yes you read that right some states dont have income tax requirements. You should register for an employer withholding tax account to report the taxes for your business employees.

How to estimate your quarterly taxes. State income taxes may also apply. Income rates range from zero to almost 13.

Youre required to submit a properly completed Form W-8BEN to the party or company thats providing you with income if youre a Canadian contractor earning income from a US. These are the best online tax software programs for 2021 and these are the best free tax programs. The form asks for your care-related expenses for the calendar year and then calculates your savings based on a percentage determined by your adjusted.

The burden is on you to pay estimated taxes four times a year April 15 June 15 September 15 and January 15 of the following year to cover your anticipated tax bill. In addition to filing federal income taxes most business owners should also be filing a state income tax return. An LLC taxed as a corporation uses Form 1120 to file taxes.

For 2020 a new baby also delivers a tax credit of up 2000 even if the child was born late in the year. Should You File State Income Taxes. Payroll is a basic necessity for every business you have to pay your employees make the correct deductions and file taxes.

Income on your Canadian tax return. If youre employed you can ask your employer to withhold more federal income tax from your wages during the year. Taxes File Your Own Taxes.

Its important to fill out the card or your tax rate could increase by nearly 8. If you try to pay a lump sum instead of making quarterly payments youll be charged interest fines and other fees. In either of these situations you will be required to file IRS Form 1040 or IRS 1040-SR along with a Schedule C.

You pay federal income taxes on a pay-as-you-go basis. Using a nanny payroll service can greatly reduce the amount of time it takes you to pay your nanny withhold your nannys taxes file your own taxes and stay up-to-date on state and federal changes to tax laws to. If you hired someone who was legal but didnt pay Social Security taxes youre probably OK but only if you come clean and pay the back taxes.

LAS VEGAS KLAS If youre a Nevada homeowner the property tax abatement law limits how much your property taxes can increase yearly. Preparing to file your taxes Explore Preparing to file your taxes. If you must pay social security and Medicare taxes or federal unemployment taxes or if you withhold income tax youll need to file Schedule H Form 1040 Household Employment Taxes.

When ranking your favorite seasons we guess tax season isnt at the top. If the nannys illegal stay in the US. When youre hired your employer should give you a Form W-4 and a state withholding form if you live in a state with income taxes so they can determine how much in income taxes to withhold each pay period.

Web Upload is a file-based system thats best if youre submitting more than a few documents and payments at once. If your employer doesnt withhold your share of these taxes you will need to pay 765 for these taxes when you file your return. Was for one year or longer when she leaves or gets deported she will trigger a ten-year bar to reentry.

But before you decide to pay either quarterly or annually consult with an accountant or tax professional. Illegally for 180 days but less than one year will upon leaving trigger a three-year bar to reentry. You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the child care tax credit.

However its not the reason you went into business. The household employer taxes paid on top of the nannys wages. You will also be required to file a tax return if youre a church employee with income of 10828 or more.

Employee babysitters should have their Social Security and Medicare taxes withheld as described above. On the other hand if you dont expect to owe more than 1000 when you file your annual return you arent required to make quarterly tax payments. IStockImgorthand iStockdjgunner iStockChahine Shields.

You file using Form 1065 and Schedule K-1. SurePayroll handles this core function for you allowing you to spend less time managing payroll and more time building your company and enjoying time away from work. The matter was widely reported by the international press with the Financial Times dubbing it Nannygate.

The form includes a declaration that youll include this US. Underpaying your taxes triggers a penalty while overpayment is the equivalent of giving the. The system accepts withholding tax data files such as spreadsheets or text files created using payroll software.

The amount withheld is based on what you claim when you fill the form out. Who also hired a live-in nanny without paying taxes.

Nanny Tax Pitfalls And Need To Knows For Your Taxes

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

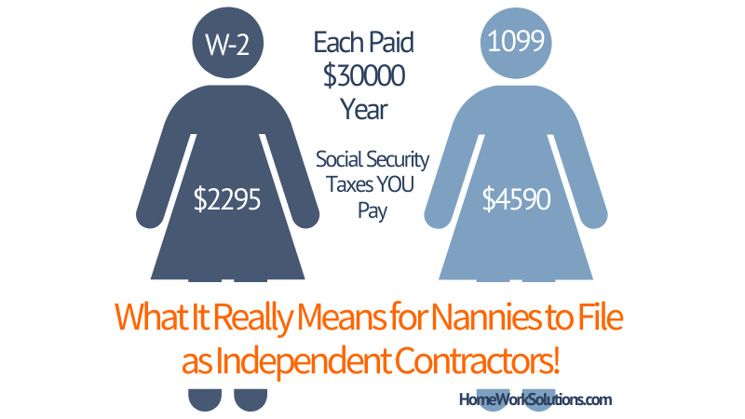

How Does A Nanny File Taxes As An Independent Contractor

Nanny Payroll Part 3 Unemployment Taxes

Babysitting Taxes Usa What You Need To Know

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Household Employees And The Nanny Tax Mark J Kohler

Can You Write Off Nanny Expenses Yes Here S How

Nanny Tax Do I Have To Pay It Credit Karma Tax

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

New Tax Reporting Rule May Change How You Pay A Nanny Or Babysitter

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Hiring A Nanny Tips On Handling Taxes And Other Costs Mybanktracker

Nanny Payroll Part 4 Federal Income Taxes

The Differences Between A Nanny And A Babysitter

How To Calculate Your Nanny Taxes